|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

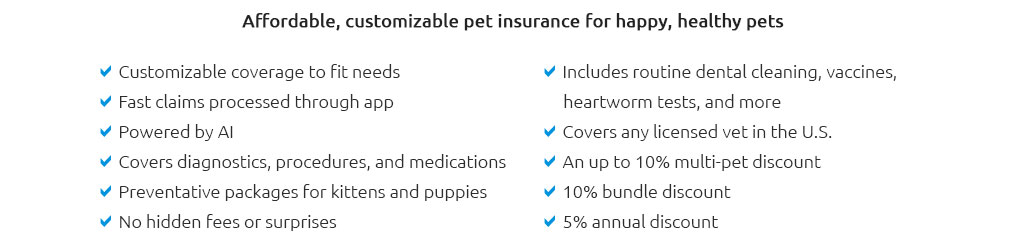

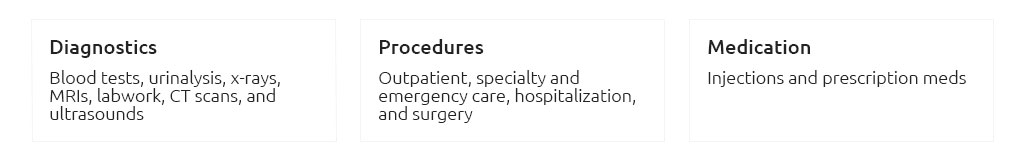

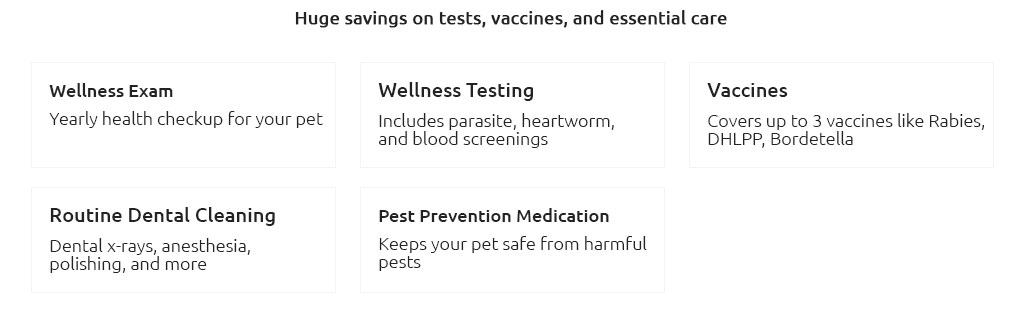

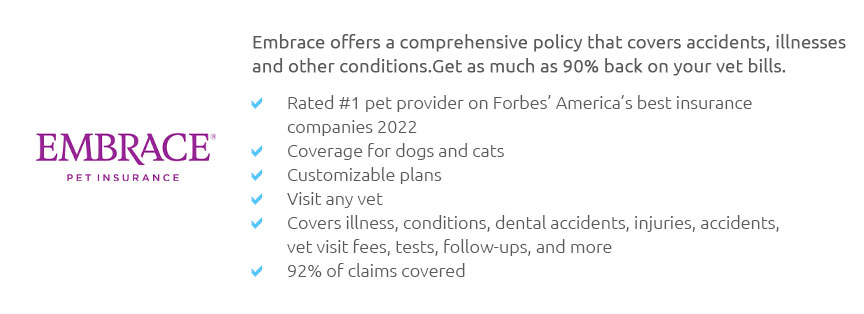

Cheap Cat Insurance for Older Cats: A Comprehensive GuideAs our feline companions gracefully age, ensuring their health and well-being becomes a paramount concern for pet owners. However, finding affordable insurance for older cats can sometimes feel like navigating a labyrinth. This article delves into the nuances of securing cost-effective insurance that meets the needs of your senior cat without breaking the bank. When it comes to cat insurance, many assume that older pets are invariably excluded from affordable options due to their increased susceptibility to ailments. Yet, with a bit of research and understanding, it is indeed possible to find cheap cat insurance that offers ample coverage. Key to this is recognizing the factors that influence insurance premiums. These often include the age and breed of the cat, pre-existing conditions, and the geographical location of the pet owner. Start with Basic Coverage: For older cats, basic coverage plans that focus on essential health issues may be the most economical choice. Such plans typically cover accidents and illnesses but might exclude pre-existing conditions. It's crucial to scrutinize what is included and excluded in these plans to ensure they align with your expectations and your cat's health profile. Consider Wellness Plans: Another cost-effective strategy is to combine basic insurance with a wellness plan. These plans cover routine check-ups, vaccinations, and preventative care, which are vital for older cats. While not insurance per se, wellness plans can significantly reduce out-of-pocket expenses and complement a basic insurance policy. Discounts and Deductibles: Investigating discounts offered by insurers can also be beneficial. Some companies offer multi-pet discounts or reduced rates for policies with higher deductibles. Although a higher deductible means more out-of-pocket expenses at the time of treatment, it can substantially lower your monthly premium, making it a viable option for those with a savings buffer. Breed-Specific Considerations: It's also worth noting that certain breeds are predisposed to specific health issues, which can influence the cost of insurance. Understanding your cat's breed-specific risks can help you choose a policy that provides adequate coverage without unnecessary add-ons. Comparative Shopping: Finally, perhaps the most effective strategy is to engage in comparative shopping. Utilize online platforms and tools that allow you to compare different insurers, policy details, and premiums side by side. This not only saves time but also ensures you get the best value for your money. To further assist pet owners, we've compiled a list of frequently asked questions about insuring older cats, along with detailed answers to guide you through this process. What is the best type of insurance for older cats? Basic coverage plans that focus on accidents and common illnesses are often recommended for older cats, especially when combined with wellness plans for routine care. Can I insure a cat with pre-existing conditions? While most policies exclude pre-existing conditions, some insurers may offer limited coverage for these cases at a higher premium. It's important to disclose all medical history to avoid claim denials. How can I reduce the cost of cat insurance? Consider opting for higher deductibles, exploring multi-pet discounts, and selecting plans with essential coverage to minimize costs. Is insurance worth it for an older cat? Insurance can be a worthwhile investment for older cats to offset the cost of potential illnesses and accidents, providing peace of mind and financial security. What should I look for in a policy for an older cat? Ensure the policy covers common age-related conditions and check the exclusions for pre-existing conditions and maximum age limits for new policies. https://www.comparethemarket.com/pet-insurance/content/older-cats/

Pet insurance, dog insurance, cat insurance, lifetime pet insurance, time limited pet insurance, tools & guides. https://www.forbes.com/uk/advisor/pet-insurance/older-cat/

We list our top five pet insurance providers below. We arrived at our top five by running quotes using our pet insurance comparison tool, and comparing ... https://www.moneysupermarket.com/pet-insurance/older-cats/

Most pet insurance providers define a senior cat is aged eight years and above. If your cat is younger than eight years old, then check out our ...

|